In the increasingly complex world of Forex trading, having a reliable trading system is essential for gaining an edge in the market. A well-established Forex trading system is not just a collection of rules; it encompasses a systematic approach that incorporates technical analysis, risk management, and trade psychology. This article delves into the various types of Forex trading systems, their benefits, limitations, and how you can adapt them to your trading style. Additionally, investors can find resources and tools for their journey at forex trading systems fxtrading-broker.com.

Types of Forex Trading Systems

Forex trading systems can be categorized into various types based on their methodology. The most common types include:

- Mechanical Trading Systems: These systems rely on predefined rules and signals generated by algorithms. Traders who use mechanical systems often follow rigid rules without discretion, allowing the system to dictate trades. This type can minimize emotional influences and maintain discipline.

- Discretionary Trading Systems: Discretionary trading allows traders to use their judgment alongside technical analysis and market conditions. This type is more adaptable but requires a deep understanding of market dynamics and the ability to analyze data effectively.

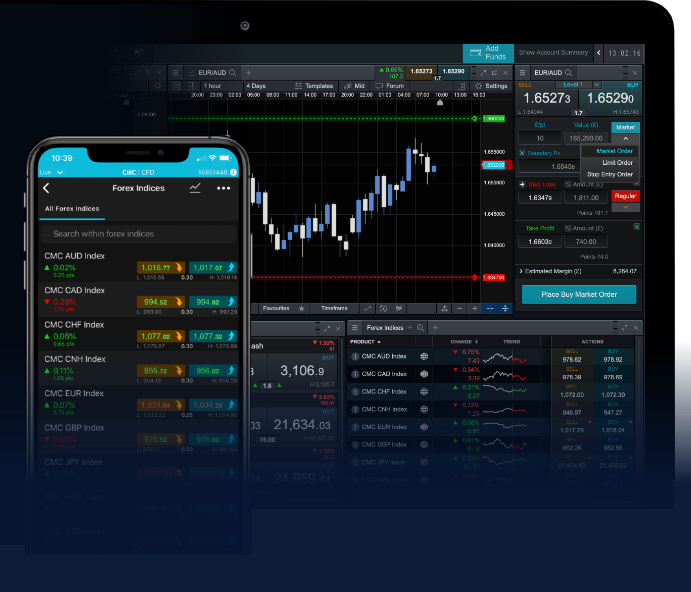

- Automated Trading Systems: Automated trading systems, or algorithmic trading systems, use programmed algorithms to execute trades automatically based on predetermined criteria. They can operate 24/7 without the need for human intervention, allowing traders to capitalize on opportunities even when they are not actively monitoring the market.

- Scalping Systems: Scalping systems focus on making small profits from numerous trades executed within a very short time frame. Scalpers depend on high-frequency strategies, often holding positions for only a few seconds or minutes.

- Position Trading Systems: Position traders hold positions for the long term, ranging from weeks to months. They analyze fundamental economic indicators and market trends to decide entry and exit points.

Benefits of Forex Trading Systems

Implementing a Forex trading system provides numerous advantages, such as:

- Consistency: A trading system backed by a solid strategy enables traders to maintain consistency in their approach, reducing the emotional component of decision-making.

- Risk Management: Organized trading systems often include inherent risk management strategies, which help protect capital and limit losses through defined stop-loss and take-profit orders.

- Clarity: By focusing on set criteria for trades, traders can avoid the confusion and overload of information that often leads to poor decisions.

- Performance Tracking: A structured approach allows traders to analyze their performance over time, identify weaknesses, and adjust their systems accordingly.

Challenges and Limitations of Forex Trading Systems

While Forex trading systems offer several benefits, they also have certain challenges and limitations:

- Market Changes: The foreign exchange market is influenced by constant economic changes; strategies that performed well in the past might not yield the same results in the future.

- Over-optimization: Traders can fall into the trap of over-optimizing their systems for historical data, leading to a discrepancy between backtested results and actual performance.

- Lack of Flexibility: Mechanical systems can become rigid and may struggle to adapt to unexpected market movements, potentially missing out on profitable opportunities.

Key Components of a Successful Forex Trading System

Creating a robust Forex trading system requires an understanding of several essential components:

1. Market Analysis

Effective market analysis can be divided into two main types: fundamental and technical analysis. Fundamental analysis involves examining economic indicators, news events, and geopolitical factors affecting currency prices. Conversely, technical analysis relies on historical price action, patterns, and indicators to forecast future movements.

2. Risk Management

Implementing sound risk management practices is critical. This includes setting realistic expectations for returns, maintaining a proper risk-reward ratio, and determining the size of positions based on individual risk tolerance.

3. Trading Psychology

The psychological aspect of trading can significantly impact decision-making. Traders must cultivate discipline to stick to their systems, manage fear and greed, and remain adaptable to changing market conditions without losing faith in their strategies.

Tips for Developing Your Forex Trading System

To enhance your Forex trading experience and develop your own trading system, consider the following tips:

- Start with a Clear Plan: Define your goals, risk tolerance, and preferred trading style before diving into system development.

- Backtest Your Strategy: Utilize historical data to evaluate the effectiveness of your trading system. This helps in identifying potential pitfalls and refining your strategy.

- Keep a Trading Journal: Maintain a record of your trades, including entry and exit points, emotions, and rationale. This hindsight can reveal patterns and areas for improvement.

- Stay Updated: Continuously educate yourself about market trends, new trading tools, and emerging strategies to adapt your system effectively.

- Practice with a Demo Account: Before applying your system in a live environment, use demo accounts to refine your skills and build confidence without risking real capital.

Conclusion

Forex trading systems play a pivotal role in the success and sustainability of traders in the foreign exchange market. By understanding the different types of systems, their unique components, and adhering to the principles of market analysis, risk management, and psychology, traders can navigate the complexities of Forex trading with greater confidence. Remember, the most crucial element of any trading system is consistency and adaptability; as markets change, so should your approach. With the right tools, strategies, and mindset, you can enhance your trading experience and potentially increase your profits in the Forex market.